Compare Mortgage Lenders & Secure Your Best Loan Rate

Buying a home is a major investment, and the mortgage you choose can affect your finances for decades. Most homeowners focus on finding the perfect house, but the lender you choose is just as crucial. Shopping with just one lender is like hiring the first contractor you find without checking their reputation or getting a second quote. You could be leaving thousands of dollars on the table or signing up for hidden fees and stressful terms. Comparing mortgage lenders is the smart, systematic way to ensure you get a fair deal on the biggest loan of your life.

Visit Compare Lenders Now to compare top lenders and secure your best loan rate.

A Simple Breakdown of Comparing Mortgage Lenders

Comparing mortgage lenders means getting loan estimates from multiple banks, credit unions, and online lenders to see who offers you the best overall package. It’s not just about finding the lowest advertised rate. It’s about evaluating the complete picture: the interest rate, the fees, the loan terms, and the quality of service you’ll receive throughout the life of your loan.

Think of it like a detailed home inspection. You’re inspecting the loan offer to understand its true cost and condition. A slight difference in your rate, say just 0.25%, can save you tens of thousands over 30 years. By comparing, you empower yourself with information and become a savvy financial shopper.

The Key Components of a Loan Estimate

When you compare, you’ll receive a standardized Loan Estimate from each lender. This three-page document is your most important tool. It clearly outlines the loan terms, projected payments, and all closing costs. This standardization makes an apples-to-apples comparison possible, so you can see exactly where one lender might be cheaper or more expensive than another.

Why It Matters for Homeowners

Failing to compare lenders can be a costly mistake. Mortgage products are not one-size-fits-all. What works for your neighbor may not be the best fit for your financial situation. A lender that seems great on a billboard might have high origination fees or slower processing times that could jeopardize your closing date.

The benefits of comparing are clear and substantial. You gain leverage to negotiate better terms, uncover potential savings you didn’t know existed, and find a lender whose communication style and process align with your needs. Most importantly, you secure long-term financial health by locking in a manageable monthly payment and minimizing total interest paid. Understanding how much mortgage you can afford is the critical first step before you even start comparing offers.

Getting multiple quotes also protects you. It reveals if one lender’s offer has unusually high fees or restrictive terms. In the complex world of home financing, being an informed borrower is your best defense against overpaying.

Common Issues and Their Causes

Many homeowners run into avoidable problems during the mortgage process because they didn’t compare lenders thoroughly. These issues often stem from a lack of information or rushing the decision.

One major issue is “junk fee” surprise. Some lenders advertise a low rate but bury costs in excessive processing, underwriting, or application fees. Without a side-by-side comparison, these fees can go unnoticed until closing. Another common problem is a mismatch in service expectations. A big bank might offer a competitive rate but provide impersonal service and slow response times, adding stress to an already complex process.

- Rate Disappointment: Being quoted one rate initially only to have it rise significantly at locking, often due to not understanding how credit score or loan-to-value ratio affects the final offer.

- Closing Delays: Choosing a lender with a reputation for slow underwriting can push back your closing date, potentially risking your contract with the seller.

- Rigid Loan Options: A lender may only push a few standard products, not offering guidance on whether an ARM vs. Fixed-rate mortgage is better for your specific timeline.

- Poor Communication: You can’t get clear answers from your loan officer, leaving you in the dark about your application status.

How Professionals Simplify the Comparison Process

Just as a skilled contractor manages all the tradespeople on a renovation, a modern mortgage comparison platform streamlines the search for you. Instead of you spending hours filling out forms on dozens of different websites, these services allow you to input your information once. They then connect you with multiple, pre-screened lenders who compete for your business.

The process is designed for clarity and efficiency. You receive multiple Loan Estimates in a similar timeframe, making direct comparison straightforward. A good platform also provides educational resources, helping you understand the differences between loan types and terms. This professional approach saves you time, reduces the hassle of fielding countless calls, and presents your options in a clear, manageable format so you can make a confident decision.

- You provide your basic financial snapshot and home buying goals.

- The platform matches you with relevant lenders who provide real, personalized estimates.

- You review and compare the offers side-by-side, with support to understand the details.

- You choose the best offer and move forward with your selected lender.

Signs You Should Not Ignore

When you’re reviewing loan offers, certain red flags should prompt you to look more closely or walk away. These signs often indicate a lender who is not transparent or may not have your best interests in mind.

Pressure to act immediately on a “today-only” rate is a classic warning. Reputable lenders know rates fluctuate, but they won’t use high-pressure tactics. Similarly, if a lender is hesitant to provide a written Loan Estimate after you’ve provided basic information, that’s a major concern. All communication and promises should be documented.

Visit Compare Lenders Now to compare top lenders and secure your best loan rate.

- Vague or Evasive Answers: The loan officer can’t or won’t clearly explain fees, terms, or the reasons behind a rate quote.

- Requests for Upfront Fees: Legitimate lenders do not ask for large sums of money for a “processing fee” before providing a Loan Estimate.

- Guaranteed Approval Without Checking Credit: This is unrealistic and often a ploy to get your information.

- Advice to Inflate Your Income: Any suggestion of falsifying loan documents is illegal and a sign of a fraudulent operation.

- The Offer Seems Too Good to Be True: A rate drastically lower than all other quotes often comes with hidden trade-offs or fees.

Cost Factors and What Affects Pricing

Understanding why lenders offer different rates and fees helps you compare more effectively. Your personal financial profile is the biggest factor. Your credit score, debt-to-income ratio, and the size of your down payment directly influence the risk the lender takes, which is reflected in your rate.

The loan itself also determines cost. The loan term (15 vs. 30 years), the loan type (conventional, FHA, VA), and whether you pay points to buy down the rate all change the final numbers. For specialized loans, it’s wise to compare FHA mortgage rates from lenders experienced with that product. Finally, lender-specific operating costs and profit margins play a role. A local credit union might have lower overhead than a national bank, potentially resulting in lower fees.

How To Choose the Right Professional or Service

Selecting the right lender is the final, crucial step after you’ve compared your options. Look beyond the numbers. Consider the loan officer’s responsiveness and willingness to educate you. Were they patient with your questions? Did they proactively explain the next steps?

Research the lender’s reputation. Read online reviews, check their rating with the Better Business Bureau, and ask friends or your real estate agent for referrals. A lender with a track record of smooth closings and good communication is invaluable. Remember, you’ll likely have a relationship with this company for many years, especially for questions about payments or loan servicing.

- Check licensing through the NMLS Consumer Access website.

- Ask about their average time to close a loan.

- Confirm who will service the loan after closing—the lender or a third party.

Long-Term Benefits for Your Home

Taking the time to compare lenders thoroughly pays dividends for the entire time you own your home. The most obvious benefit is significant financial savings. A better rate and lower fees translate directly into lower monthly payments and more money staying in your pocket over the life of the loan.

This financial flexibility can allow you to pay for home maintenance, renovations, or invest in other areas of your life. Furthermore, a loan with terms you understand and can comfortably afford reduces financial stress, contributing to the overall peace of mind that comes with homeownership. You gain the confidence that you made a well-researched, intelligent decision for your family’s future.

Frequently Asked Questions

How many mortgage lenders should I compare?

It’s recommended to get Loan Estimates from at least three different types of lenders: a large national bank, a local credit union, and an online mortgage lender. This gives you a broad view of the market and helps identify the best deal for your scenario.

Does comparing mortgage lenders hurt my credit score?

Not if done within a focused shopping period. Credit scoring models treat multiple mortgage inquiries within a short window (typically 14-45 days) as a single inquiry for rate-shopping purposes. This allows you to compare without a significant impact on your score.

What is more important, the interest rate or the APR?

You need to look at both. The interest rate determines your monthly payment. The Annual Percentage Rate (APR) includes the interest rate plus most lender fees, giving you a better picture of the total annual loan cost. Use the rate to budget monthly and the APR to compare total cost between lenders.

When is the best time to start comparing lenders?

Start before you begin seriously house hunting. Getting pre-approved for a mortgage involves a basic comparison and makes you a stronger buyer. It gives you a realistic budget and shows sellers you’re serious.

Can I negotiate with mortgage lenders?

Absolutely. Having competing offers is your strongest negotiating tool. If one lender’s rate is lower, ask another if they can match or beat it. You can also ask for specific fees to be reduced or waived. Lenders often have some flexibility to win your business.

Are online lenders as reliable as traditional banks?

Many online lenders are reputable and often offer competitive rates due to lower overhead. The key is to research them just as you would a brick-and-mortar bank. Check their reviews, licensing, and ensure you have a direct point of contact you can reach easily.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is a quick, informal estimate based on unverified information you provide. Pre-approval is a more thorough process where the lender checks your credit and verifies your financial documents, resulting in a conditional commitment for a specific loan amount. Sellers and agents take pre-approval much more seriously.

Should I use a mortgage broker or go directly to a lender?

A mortgage broker can shop multiple lenders on your behalf, which is a form of comparison. Going directly to lenders means you do the shopping yourself. Both paths can work; the important thing is that multiple sources are compared to ensure you get a competitive offer.

Finding the right mortgage lender is a foundational step in your homeownership journey. By investing a few hours in a careful, side-by-side comparison, you secure not just a house, but a financially sound future. You gain control, confidence, and the satisfaction of knowing you made the smartest choice for one of life’s biggest commitments.

Visit Compare Lenders Now to compare top lenders and secure your best loan rate.

Recent Posts

Compare Mortgage Lenders & Secure Your Best Loan Rate

Comparing mortgage lenders is the smart way to save thousands on your home loan. Learn how to evaluate rates, fees, and service to secure your best deal.

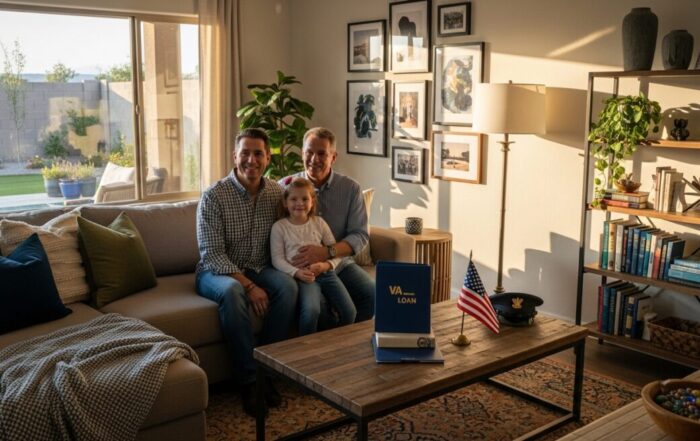

VA Home Loan Benefits Explained for Homeowners and Veterans

Discover the powerful VA home loan benefits for veterans, including no down payment, no PMI, and flexible credit. Learn how this earned benefit makes homeownership simple.

Your Guide to First Time Buyer Mortgage Options

Discover clear, simple explanations of first time buyer mortgage options. Learn about low down payments, credit scores, and programs designed to help you buy your first home.

Your Monthly Mortgage Payment Estimate Explained for Homeowners

Understand what goes into your monthly mortgage payment estimate. Get a clear breakdown of principal, interest, taxes, and insurance to budget confidently.