Frequently Asked Questions About Mortgage Refinancing

What is mortgage refinancing?

When you refinance, you get a new mortgage to replace your current home loan. Just like when you buy the house, you will most likely pass a credit check and pay the closing costs. Some lenders offer zero cost refinancing where you pay a higher interest rate if you pay little or nothing at closing.

Why refinance your mortgage?

There are many reasons to refinance your mortgage. People often refinance to save money in the short or long term and sometimes take out capital loans. Here are some of the main reasons for refinancing:

To get a lower mortgage rate. If mortgage rates go down after getting the loan, you may be able to refinance at a lower interest rate. This can result in lower monthly payments.

To shorten the term. Refinancing a 30-year mortgage on a short-term loan (most often 15 or 20 years) can increase your monthly payment (even with a lower interest rate), but reduce the general interest you pay for life. of the loan.

Get rid of mortgage insurance. If you buy a home with a down payment of less than 20%, you must pay mortgage insurance. Refinancing is one way to stop paying for private mortgage insurance and the only way to get rid of FHA mortgage insurance.

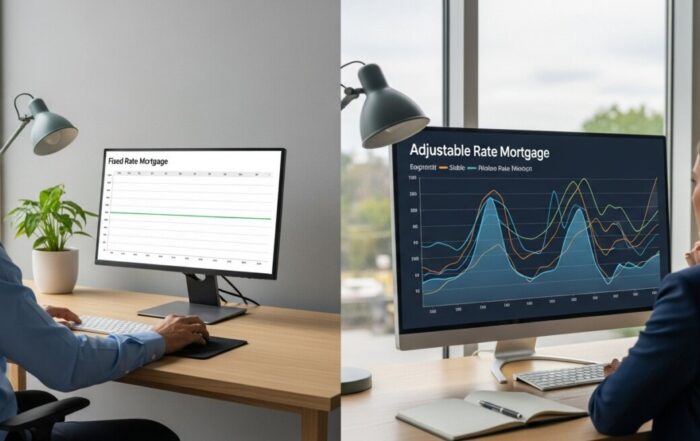

Replace an adjustable-rate mortgage with a fixed-rate loan. Instead of bearing the uncertainty of annual interest rate adjustments with an ARM, you can refinance a fixed-rate loan so you don’t have to worry about rising rates.

Have justice in your hands. With refinancing cash withdrawals, you borrow more than your current loan balance and make the difference in cash. Refinancing cash withdrawals is a popular form of payment for home improvement.

When can you refinance a mortgage?

You can refinance as often as it makes financial sense. There is one exception: some lenders require a “chili” between refinances. In other words, you must have the loan for a certain number of months before you can refinance it again.

How do you refinance your mortgage?

The first step in refinancing is to determine your goal. Do you want to reduce your monthly payment? Short term? Get rid of FHA mortgage insurance? Go from an ARM to a fixed rate? Borrow capital?

Once you have set your goal, buy a refinance lender, apply and close your new mortgage like when you bought the house.

Recent Posts

What Is a Mortgage Interest Rate? A Complete Explanation

Understand what a mortgage interest rate truly is and how it impacts your monthly payment and total loan cost. This complete explanation helps you secure the best possible loan.

Mortgage Pre Approval Explained: Your Home Buying Roadmap

A mortgage pre approval defines your true budget and strengthens your offer with sellers. Learn how mortgage pre approval works to become a competitive buyer.

Fixed vs Adjustable Mortgage: A Complete Guide to Choosing

Understand the fixed vs adjustable mortgage meaning to choose the right loan. This guide helps you secure stable payments or maximize initial savings based on your financial plan.

How Much Down Payment Do You Need for a Mortgage?

Learn how much down payment is needed for a mortgage, from 0% to 20%, and discover the loan types and strategies that make homeownership achievable.