Mortgage Down payments tips

1. Save for an advance

It’s common to cut 20%, but many lenders now allow far less, and first-time buyer programs only allow 3%. However, paying less than 20% can mean higher costs and mortgage insurance, and even a small down payment can be substantial. For example, a 5% deposit for a house of $200,000 is $10,000.

Play with this down payment calculator to get a target amount. Some tips for saving on a down payment include booking tax refunds and employment bonuses, setting up an automatic savings plan.

2.Learn about your down payment and mortgage options

There are many mortgage options, each with its own combination of pros and cons. If you are having trouble making a deposit, check out these loans:

Conventional mortgages

They meet the standards set by state-sponsored companies Fannie Mae and Freddie Mac and only require a 3% discount.

FHA loan

Loans insured by the Federal Housing Administration allow a deposit of only 3.5%.

VA loan

Loans guaranteed by the Department of Veterans Affairs sometimes require no down payment. A higher down payment means a lower monthly mortgage payment.

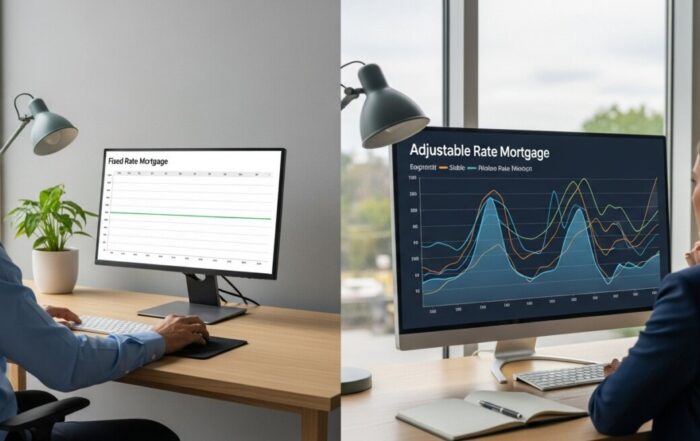

If you want the lowest possible mortgage payment, choose a 30-year fixed-rate mortgage. However, if you can make larger monthly payments, you can get a lower interest rate with a fixed loan of 20 or 15 years. Or you prefer an adjustable-rate mortgage which is riskier but which guarantees a low-interest rate for the first years of your mortgage.

3. Examine government and local aid programs.

In addition to federal programs, many federal states offer first aid programs to home buyers with benefits such as down payment assistance, final cost assistance, tax credits, and interest rates. reduced interest. There may also be first-time buyer programs in your county or municipality.

Recent Posts

What Is a Mortgage Interest Rate? A Complete Explanation

Understand what a mortgage interest rate truly is and how it impacts your monthly payment and total loan cost. This complete explanation helps you secure the best possible loan.

Mortgage Pre Approval Explained: Your Home Buying Roadmap

A mortgage pre approval defines your true budget and strengthens your offer with sellers. Learn how mortgage pre approval works to become a competitive buyer.

Fixed vs Adjustable Mortgage: A Complete Guide to Choosing

Understand the fixed vs adjustable mortgage meaning to choose the right loan. This guide helps you secure stable payments or maximize initial savings based on your financial plan.

How Much Down Payment Do You Need for a Mortgage?

Learn how much down payment is needed for a mortgage, from 0% to 20%, and discover the loan types and strategies that make homeownership achievable.