The 3 Most Common Risks Of Payday Loans And How To Avoid Them

Each year, about 12 million Americans depend on payday loans to cope with income fluctuations or to cope with unforeseen emergencies. While payday loans are used to solve a very real problem, abusive lenders often abuse consumers.

Due to limited regulation and the lack of better options, it is not uncommon to read horror stories about people accused of annual interest rates over 1000% or trapped in debt.

Once a person finds themselves in a downward spiral of debt with infinite transfers and hidden fees, they can quickly identify their damaged loans and empty bank accounts, especially if they take out a loan from a particularly unscrupulous lender.

Payday loan tactics like hidden fees, bank transfers, and high-interest rates have caused 22 states. The USA Restrict or completely ban payday loans.

Why do people get payday loans?

Many people simply have no choice. For someone affected by low wages, income fluctuations, or an unforeseen emergency, a payday loan may be the only option to reduce your income shortfall. While it cannot completely resolve a person’s financial difficulties, it does offer a temporary solution. Unfortunately, more than 80% of payday loans are “rolled over” to a new loan, or the borrower takes out another loan immediately after the old loan is repaid.

If a lender has no guidelines on how to avoid wire transfers and does not offer flexible payment options, financial disaster becomes an inevitable reality for most borrowers.

What happens to someone who has entered a cycle of debt traps?

In general, when a person is unable to repay a payday loan by the first due date, most lenders agree to delay the payment by charging the borrower “reinvestment fees” while leaving the principal of the loan unchanged.

Very often the fees considerably exceed the actual loan amount and some borrowers pay thousands of dollars in reinvestment fees. The only way to avoid debt traps is to stay away from reinvesting lenders.

How to Avoid the Pitfalls of Payday Loans?

With basic financial training, it is possible to avoid the dangers of payday loans. With so many borrowers having no other option, it is crucial to have all the information.

Danger 1: do not consider cheaper alternatives

Before getting a payday loan, you must first consider your other options for raising the money you need. To avoid borrowing money on a payday loan, the following options may be helpful:

Reduce costs: you can reduce your discretionary costs by avoiding impulse purchases.

At the same time, generate additional income – You can try doing self-employment, a side project or another part-time job to generate additional income.

Sell personal items you no longer need: sell old items you don’t need to someone who can use them, or to a pawnshop.

Some loan options that can be cheaper than a payday loan:

A credit card advance: consider taking a credit card advance and paying on your next paycheck.

Personal loan: request a personal loan from a bank or credit union to cover your expenses.

Advance from an employer: It is also an option to request an advance from your employer and withdraw the money from your next paycheck.

Loans from friends and family: Borrow money from family members and pay it back. This option can often be uninteresting.

Danger 2: unauthorized lenders

An unlicensed lender can be a so-called lender and should be avoided if possible.

Lenders are unlicensed lenders who tend not to comply with state law and very often use abusive lending practices to exploit consumers, for example, charging excessive interest rates, defrauding consumers in debt traps or practicing illegal debt collection practices. debt.

A licensed lender, however, is licensed to do business in your state and is subject to the laws of that state. To confirm whether a lender is approved, contact the state regulator or the attorney general.

Danger 3: Payday Loan Broker

A “broker” for payday loans is a website or institution that does not lend money directly to consumers. Instead, a person has to go through several companies that act as payday loan brokers to get a payday loan.

Getting a loan from a direct lender is often a safer and cheaper option because fewer companies that act as payday loan brokers have access to your personal information and are less likely to incur “brokerage fees”.

Recent Posts

What Is a Mortgage Interest Rate? A Complete Explanation

Understand what a mortgage interest rate truly is and how it impacts your monthly payment and total loan cost. This complete explanation helps you secure the best possible loan.

Mortgage Pre Approval Explained: Your Home Buying Roadmap

A mortgage pre approval defines your true budget and strengthens your offer with sellers. Learn how mortgage pre approval works to become a competitive buyer.

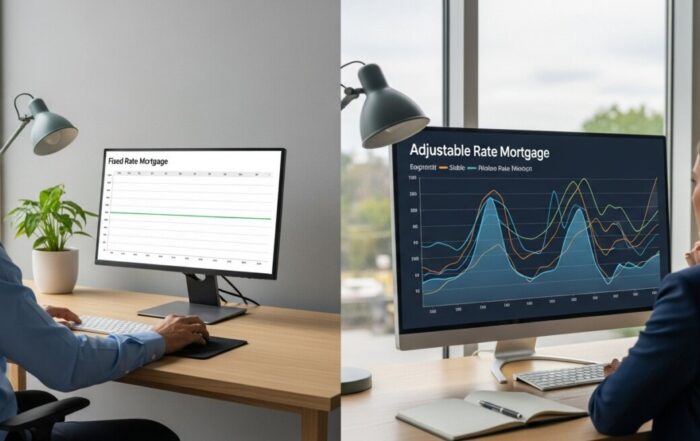

Fixed vs Adjustable Mortgage: A Complete Guide to Choosing

Understand the fixed vs adjustable mortgage meaning to choose the right loan. This guide helps you secure stable payments or maximize initial savings based on your financial plan.

How Much Down Payment Do You Need for a Mortgage?

Learn how much down payment is needed for a mortgage, from 0% to 20%, and discover the loan types and strategies that make homeownership achievable.