HELOC: Understanding Home Equity Lines of Credit

With a Home Equity Line of Credit (HELOC), you can take out loans against the value of your home to access cash when needed.

What is a capital line of credit?

A home equity line of credit (HELOC) is a second mortgage that gives you access to cash based on the value of your home. You can take money out of a home equity line of credit and pay it off in whole or in part on a monthly basis, like a credit card.

With a HELOC, you borrow against your principal amount, which is the value of your home minus the amount you owe for the primary mortgage. You can also get a HELOC if you own your home directly. In this case, HELOC is the primary mortgage instead of a second.

Whether a HELOC is a secondary or primary mortgage, you can lose the home through foreclosure if you fail to make the payments.

How does a home equity line of credit work?

Like a credit card that lets you borrow within your spending limit as often as needed, a HELOC gives you the flexibility to borrow, pay, and repeat against your home equity.

Most HELOCs have adjustable interest rates. This means that as your benchmark rates go up or down, your HELOC rate will adjust as well.

To set your interest rate, the lender starts with an indexation rate and then adds a margin based on your credit profile. As a general rule, the higher your credit rating, the lower your profit margin. This margin is called the margin. You must request the amount before unsubscribing from HELOC.

Variable interest rates make you vulnerable to rising interest rates. So keep that in mind. Look at the size of the periodic limit, how much the interest rate can change at any time, and the lifetime limit, the highest interest rate you can calculate over the life of the loan, to get a feel for the height of the interest rate. Could your payments get?

On the plus side, like a credit card, you only pay interest on the amount of money you use, not the total amount available to borrow.

How to get a home equity line of credit

The process of obtaining a HELOC is similar to that of a purchase mortgage or refinance. It will provide some of the same documentation and show that it is a solvent. Here are the steps you will follow:

- Use a HELOC calculator to determine if you have enough capital.

- If you have an idea of what you can borrow, buy from HELOC lenders.

- Gather the necessary documentation before making the request so that the process runs smoothly.

- Once you have gathered your documents and selected a lender, apply for HELOC.

You will receive the disclosure documents. Please read them carefully and ask questions of the lender. Make sure HELOC meets your requirements. For example, do you have to borrow thousands of dollars upfront (often called an initial drawing)? Do you need to open a separate bank account to get the best price for HELOC?

The subscription process can take hours or weeks and include an appraisal to confirm the home’s value.

The last step is to close the loan when you sign the documents and the line of credit is available.

How much can you borrow with a HELOC?

The maximum amount of your home loan line depends on the value of your home, what percentage of that value the lender gives you to borrow, and how much you still owe on your mortgage. Two quick calculations can give you an idea of what you can borrow with a HELOC.

Recent Posts

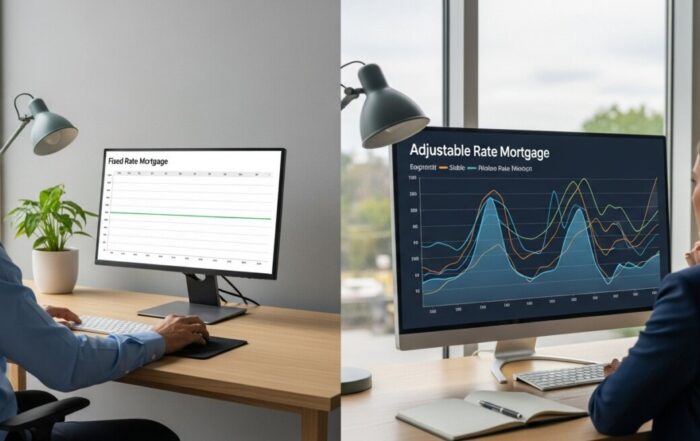

Fixed vs Adjustable Mortgage: A Complete Guide to Choosing

Understand the fixed vs adjustable mortgage meaning to choose the right loan. This guide helps you secure stable payments or maximize initial savings based on your financial plan.

How Much Down Payment Do You Need for a Mortgage?

Learn how much down payment is needed for a mortgage, from 0% to 20%, and discover the loan types and strategies that make homeownership achievable.

How to Improve Mortgage Eligibility and Secure Loan Approval

Learn actionable strategies to boost your credit, manage debt, and save effectively to improve mortgage eligibility and secure better loan terms.

Finding the Best Mortgage Lenders for First Time Buyers

Discover how to identify lenders with first time buyer programs, low down payments, and exceptional support to simplify your path to homeownership.