Why you Should refinance your mortgage?

In July, CNBC announced that eight million homeowners had left money on the table while refinancing. In December, the publication found that weekly refinancing rates had increased 314% year-over-year. Even if you hadn’t planned to refinance your mortgage before, you may have wondered if it would save you money. If you’re still wondering, you’ve come to the right place. You will learn:

What are refinanced loans and how do they work?

A refinance loan is a type of mortgage. It replaces the original mortgage you accepted for your home. You take out the refinance loan to pay off the original loan and then make the mortgage payments to the lender who provided your refinancing mortgage.

As the name of the loan suggests, homeowners often take out refinancing loans when they want to revise the financial terms of their mortgage in order to save money in one way or another. Homeowners often refinance the following:

Reduce your interest rate, which means you pay less interest over the life of the loan.

Reduce your monthly payments, even if it means paying more interest over the life of the loan.

Use some of the capital accumulated in your home. This is called “refinancing cash withdrawals”.

Withdraw your mortgage insurance.

Pay off the loan faster, which often means you have higher monthly payments but pay less interest over the life of the loan.

Get more cost stability by switching from a variable rate mortgage to a fixed-rate mortgage.

And because refinancing loans are themselves a kind of mortgage, homeowners have to go through the same process to get them as they did for an original mortgage. In particular, this means that you must qualify for the loan yourself and pay certain associated fees (including assessment and graduation fees).

Because of these two factors, mortgage refinancing is not for everyone. To find out if refinancing your mortgage can improve your financial situation, let’s look at when refinancing makes financial sense.

When it makes sense to refinance your mortgage

The goal of refinancing a mortgage loan is usually to save money, either on your monthly payments or on the general cost of your loan (as described above).

For individual owners, there are common triggers that indicate that the time has come to consider whether taking out a refinance loan makes financial sense, including Interest rates are lower than what you are currently paying. It happened in 2019 when you probably saw dozens of headlines about homeowners’ savings from the refinancing boom. Your credit improves. If you do, you can benefit from a loan on more advantageous terms than today. In this case, refinancing can make sense, even if the interest rates have not changed significantly.

You have accumulated enough capital to get rid of your mortgage insurance. Once you have 20% of the equity in your home, you can qualify to cancel your mortgage insurance. Refinancing can reduce your monthly payments.

How To Refinance Your Mortgage

Once you’ve made the numbers and found that refinancing your mortgage makes financial sense, it’s time to start. First, decide which of the following goals you want to refinance:

Payless interest over the life of the loan: you may want to lower your interest rates without expanding your current payment schedule.

Lower monthly payments: You may want lower interest rates and a longer payment schedule (for example, refinancing a new 30-year mortgage).

Use equity: you will need cash refinancing. If the initial numbers look good, it’s time to contact the lenders. It is best to compare the offers of three to five lenders to make sure you get the best deal. So:

Apply within two weeks to minimize the impact on your credit rating.

Ask your interest rates on the type of loan you want (for example, fixed-rate, 15 years, etc.).

They will contact you with credit estimates (including transaction costs). Use these figures to run your refinancing calculations again.

If everything seems fine, it’s time to go to the lender who offered you the most attractive offer and ask you to “freeze” your interest rate. The block guarantees the interest rate for a number of days during which you and your lender can try to close the loan.

This part of the process should remind you how to get your original mortgage since it’s more or less the same except that you don’t move to a new house after you’ve completed it. At this point, it’s probably a big relief!

Recent Posts

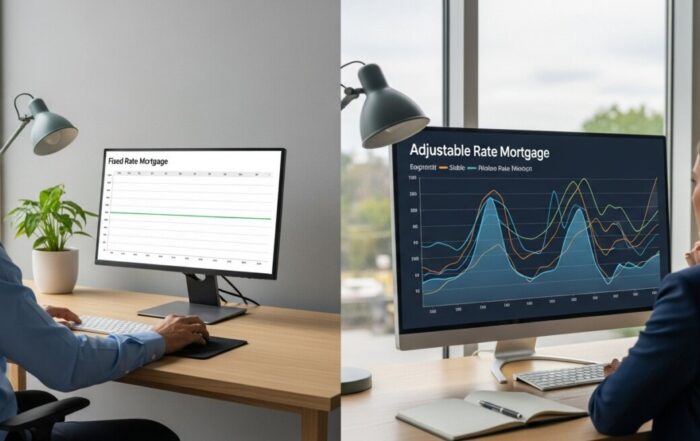

Fixed vs Adjustable Mortgage: A Complete Guide to Choosing

Understand the fixed vs adjustable mortgage meaning to choose the right loan. This guide helps you secure stable payments or maximize initial savings based on your financial plan.

How Much Down Payment Do You Need for a Mortgage?

Learn how much down payment is needed for a mortgage, from 0% to 20%, and discover the loan types and strategies that make homeownership achievable.

How to Improve Mortgage Eligibility and Secure Loan Approval

Learn actionable strategies to boost your credit, manage debt, and save effectively to improve mortgage eligibility and secure better loan terms.

Finding the Best Mortgage Lenders for First Time Buyers

Discover how to identify lenders with first time buyer programs, low down payments, and exceptional support to simplify your path to homeownership.